Workday, a powerhouse in the realm of on-demand cloud-based software, has undeniably revolutionized human capital management (HCM), payroll, financial management, and analytics applications. This robust suite of tools has made it possible to manage and track applicants, onboard new employees, manage talent, and more, all within a unified interface. However, while Workday does an exemplary job in these areas, there is one crucial element of the hiring process that is left unaddressed – the actual interviewing of candidates, particularly in a virtual setting. This is where MiaHire USA from Di Tran Enterprise comes into play.

Workday: An Overview

Workday offers an all-in-one package that assists in streamlining many day-to-day business operations. Its Human Capital Management (HCM) platform, for instance, provides tools for recruiting, talent management, payroll, and time-tracking, helping companies to maintain a dynamic and mobile workforce. Its financial management tools, on the other hand, allow for effective revenue and resource management and detailed financial reporting. These features make it a highly efficient tool for large organizations across various industry segments.

The Gap in the Workday Solution

Despite the comprehensive suite of tools that Workday offers, it lacks a dedicated component for conducting virtual interviews. As we navigate the era of remote work and virtual teams, having a solution that supports virtual interviewing is not just a nice-to-have, it’s a must-have. This is where MiaHire USA comes in.

MiaHire USA: The Perfect Complement to Workday

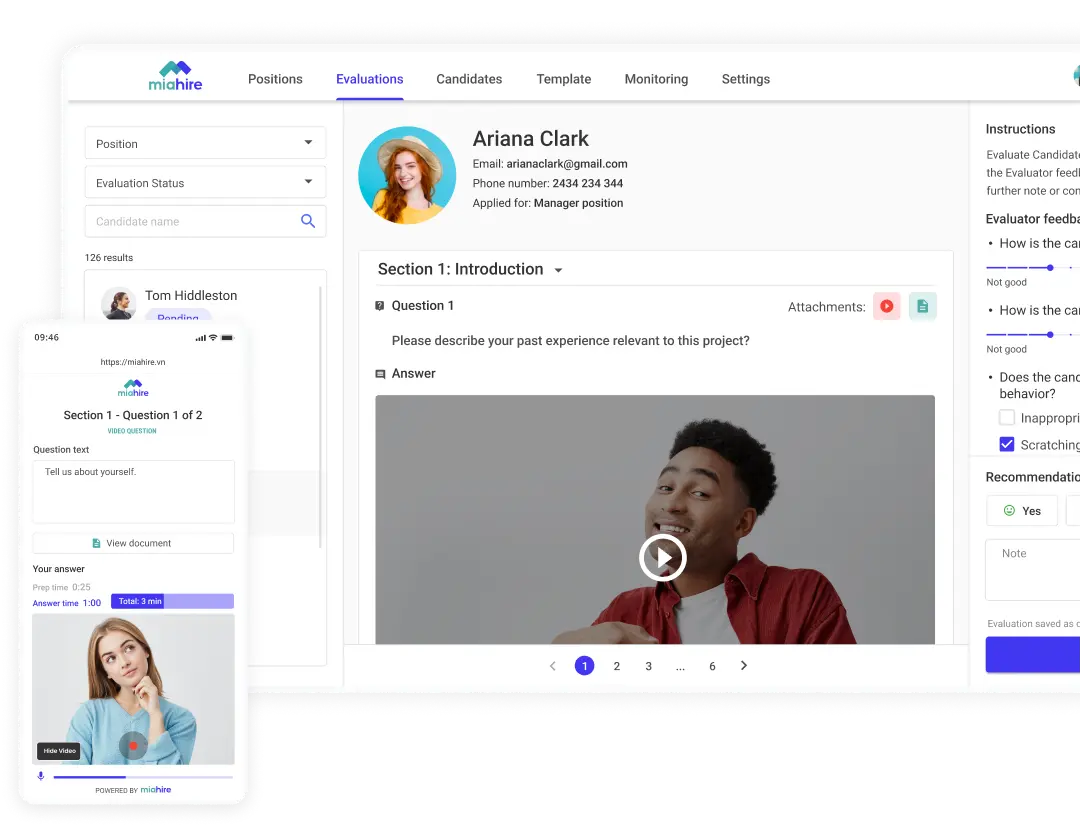

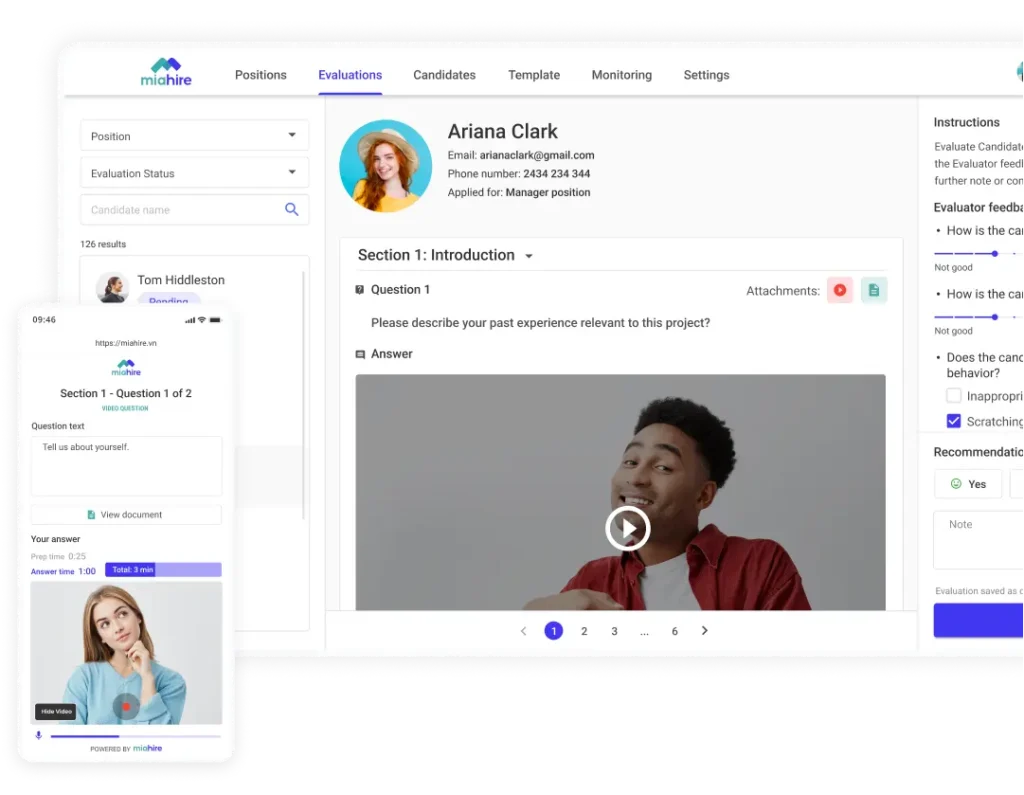

MiaHire USA is an innovative company operating a platform called MiaHire.com, which offers a Virtual One-way Interview hiring solution. It has been designed to alleviate 85% of labor-intensive work for HR departments, dramatically reducing the time and resources spent on the initial stages of recruitment. This can particularly complement Workday’s recruitment and talent management tools.

By integrating MiaHire USA with Workday’s existing infrastructure, companies can streamline the interview process. MiaHire’s Virtual One-way Interview platform allows potential candidates to record their responses to interview questions at their convenience, and HR personnel can review these responses at their own pace. This asynchronous interviewing process not only makes it easier for candidates to apply but also helps HR departments manage their time and resources more effectively.

Furthermore, this process allows for a more equitable approach to initial screenings, as it eliminates potential biases that can occur in live interviews. Candidates are evaluated based on their responses alone, which can contribute to a more diverse and inclusive workforce.

The Result: A Comprehensive, End-to-End Hiring Solution

By combining Workday’s robust HR management tools with MiaHire’s innovative virtual interviewing platform, businesses can achieve a truly end-to-end hiring solution. From the initial job posting and applicant tracking through Workday, to the interviewing process via MiaHire, companies can manage the entire hiring process in a streamlined, efficient, and inclusive way.

Workday and MiaHire USA can thus be viewed as two pieces of a jigsaw puzzle, each complementing the other perfectly to form a complete picture. In the fast-paced world of HR management, such a comprehensive, end-to-end solution can provide businesses with the edge they need to attract, evaluate, and onboard the best talent.